Affordable access to premium credit risk intelligence

A next-gen bureau, built for how business works today.

CreditProtect helps all businesses make faster, safer credit decisions, without the complexity of traditional tools.

Start with a bureau that just works

Everything you need to onboard, monitor, and collect, with AI insights that keep you ahead.

Onboarding

Automated checks to qualify customers faster, without the admin.

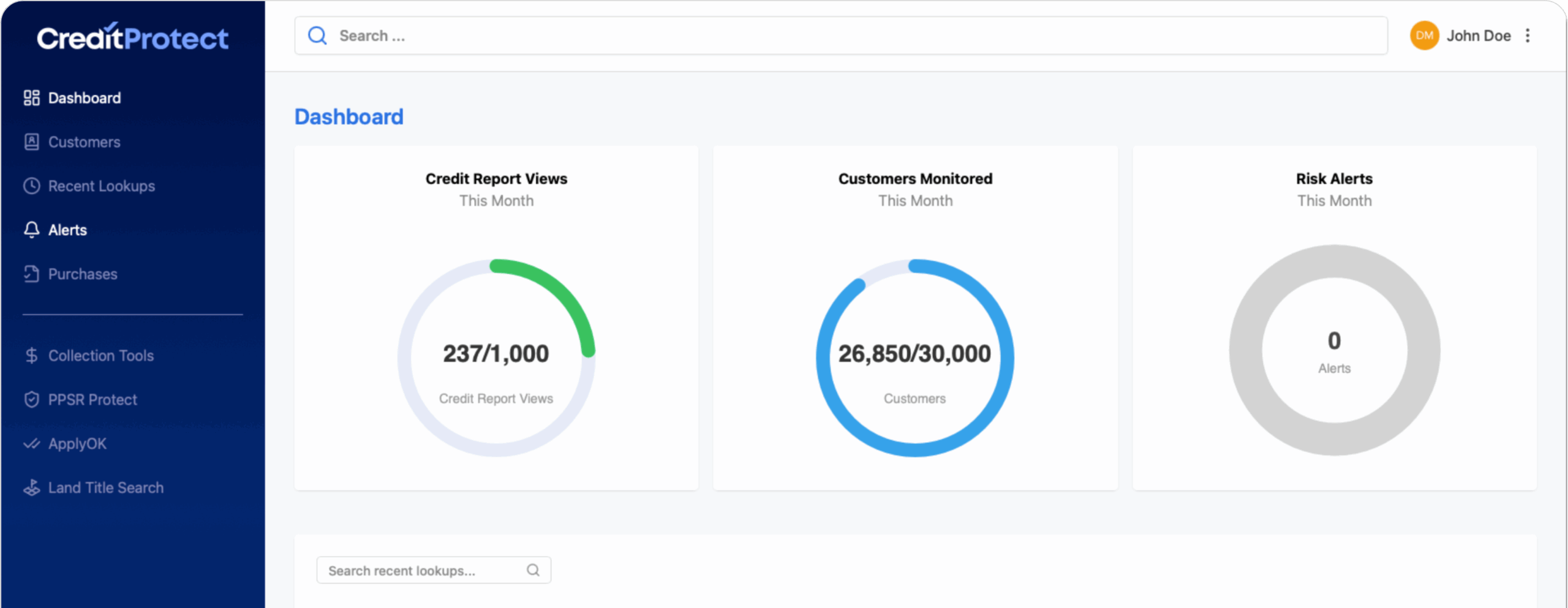

Credit Reports

Access rich credit data, company records, and scoring in one place.

Monitoring & Alerts

Real-time updates on defaults, insolvencies, and legal activity.

Collections

Tools and data to help you collect smarter and earlier.

Built for business owners, credit teams, and finance leaders.

Trusted by Australian businesses to reduce risk and improve collections.

CreditProtect has been a game-changer for our business! Their cost-effective and user-friendly platform has streamlined our processes, ensuring we are paid on time.

Better Sets

As a small business working with commercial and industrial companies, it was crucial for us to have confidence in our contracting partners. CreditProtect provided a simple and affordable solution, giving us the peace of mind we needed. Thank you

SND Electrics

I know credit reporting firsthand, and now CreditProtect has transformed how efficiently we can assess a prospective client, and fair pricing makes it a standout solution for our business.

The INSTABooth

Using CreditProtect gives us confidence, knowing we’re unlikely to encounter any surprises.

Onewifi

CreditProtect gives us access to powerful credit insights at a fraction of the cost of the larger bureaus. The platform is modern, intuitive, and built for the way we work today. We’re getting faster, smarter insights without the complexity.

Vertical Patch

Markets we help serve & protect

From trade credit to high-volume onboarding, CreditProtect supports businesses across all sectors.

Construction and Engineering

Transport and Logistics

Manufacturing and Industrial

Telco, Utilities and Energy

Fast Moving Consumer Goods

Financial Services (Non-Banking)

Trade and Wholesale

Collection Agencies & Finance Brokers

Law Firms

Education and Insurance

CreditProtect FAQs

What is a commercial credit bureau, and how does CreditProtect help my business?

A commercial credit bureau collects and shares information about companies’ financial health. CreditProtect is Australia’s newest commercial credit bureau, giving businesses of all sizes access to affordable, real-time business credit reports and monitoring. This helps you assess customer risk, reduce bad debt, and make faster, safer credit decisions.

What information is included in a CreditProtect business credit report?

Our Australian business credit reports include company records, court judgments, payment defaults, ATO tax default data, director details, and credit score movements. Each report is designed to give you a clear picture of a company’s credit risk and financial stability.

Where does CreditProtect source its credit data?

CreditProtect sources data from trusted official channels — including the Australian Business Register, the ATO, Australian courts, and reciprocal data sharing with illion (an Experian company). This combination ensures you access one of the most comprehensive business credit data sets in Australia.

How often is credit information updated in the CreditProtect platform?

We update daily, so your credit monitoring alerts reflect the most current information. If there’s a new court action, default, or director change, you’ll be notified instantly — helping you act before a customer’s financial risk impacts your business.

What’s the difference between reports, monitoring, and alerts?

- Business credit reports provide a one-time snapshot of a company’s risk profile.

- Credit monitoring tracks your customers and suppliers continuously.

- Risk alerts notify you instantly when a business shows signs of financial stress, such as defaults, court actions, or an ATO tax debt listing.

How easy is it to get started with CreditProtect?

Extremely easy. We can set you up immediately, and you can start running company credit checks in minutes. Our self-serve platform enables you to upload customer lists or run one-off searches, and our Customer Success team provides support throughout setup and training.

Can CreditProtect integrate with my accounting or CRM system?

Yes. CreditProtect can integrate with your ERP, accounting, or CRM software via API, allowing you to streamline credit risk management. For quick checks, you can also bulk upload customer lists in CSV format.

Is CreditProtect recognised by trade credit insurers and lenders?

Yes. CreditProtect reports are approved by leading trade credit insurers in Australia — including QBE, Allianz Trade, and Atradius. This means you can rely on our reports to support credit insurance decisions and justify discretionary credit limits.